Florida Limited Liability Company

$154.95

Price Includes Florida LLC $125 Filing Fee!

Each Florida Limited Liability Company is COMPLETE and:

INCLUDES Florida's $125 State Filing Fee,

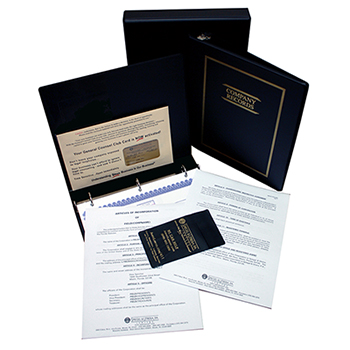

INCLUDES LLC Seal and Book,

INCLUDES Articles of Organization,

INCLUDES LLC Minutes,

INCLUDES LLC Regulations,

INCLUDES Membership Certificate,

INCLUDES Preliminary Name Search,

and talk to a lawyer to get legal advice at no extra cost!

Lastly, we have a 110% Lowest Price Guarantee

INCLUDES LLC Seal and Book,

INCLUDES Articles of Organization,

INCLUDES LLC Minutes,

INCLUDES LLC Regulations,

INCLUDES Membership Certificate,

INCLUDES Preliminary Name Search,

and talk to a lawyer to get legal advice at no extra cost!

Lastly, we have a 110% Lowest Price Guarantee

We will NOT be undersold.

FORM AN LLC BY PHONE: 1-800-603-3900

Submit contact details for immediate assistance:

WHAT’S A LIMITED LIABILITY COMPANY?

The Limited Liability Company (“LLC”) is a hybrid entity that is very flexible and, depending on how many owners (known as “Members”) and what such Members elect to do, may be taxed as a partnership or corporation, if it has multiple Members, or as a sole proprietorship, if it has only one member, while providing limited liability protection for all of its Members. For federal tax purposes, an LLC, like a partnership or sole proprietorship, is a pass-through entity; thus, its income and losses are taxed only at the member level. However, all members of an LLC, like the shareholders of an S corporation, have limited liability for the debts and claims against the LLC. No member will be burdened with the personal liability.

The Main Advantage of the LLC

The main advantage of the LLC is that it is not burdened with the ownership restrictions imposed on a small business corporation (also known as a Sub Chapter S Corporation). An LLC may have more than 100 Members or as few as one. Its interests may be held by corporations, partnerships, Non Resident Aliens, trusts, pension plans and charitable organizations; the LLC may make special allocations, thereby avoiding the single class of stock requirement applicable to an S corporation; and it may own more than 80% of the stock of a corporation and, therefore, may be a member of an affiliated group.

Capital Contribution

The Members of the LLC become owners of the Company by putting capital (making a “Capital Contribution”) into the Company in exchange for a Membership Interest, which is expressed as a percentage. Typically, the allocation of profits and losses are proportionate to the Membership Interest. The Capital Contribution can be money, real estate, equipment, future service (“sweat equity”) etc., and if it is something other than money, it should be assigned a value agreed upon by the Members. For example, Bill and Mike want to set up a company to operate a retail athletic goods store. Bill puts in $51,000 and Mike will work 60 hours next year managing the store and his sweat equity will have an agreed upon value of $49,000.

Management Agreement

The LLC is operated by Managers that handle the day-to-day activities of the LLC. The Managers may be all of the Members, some of the Members, or it may even be managed by a person or entity that has no ownership interest in the company. Since such a non-Member Manager will not share in the profits and losses, perhaps they will be paid a salary or commission as agreed upon in a Management Agreement.

Tax Benefits

For tax purposes, an LLC taxed as a partnership or sole proprietorship may have advantages over a Subchapter S Corporation with respect to the amount of deductible losses. The amount of a Subchapter S Corporation shareholder's deductible losses is limited to the sum of the shareholder's basis in his stock and any loans from the shareholder to the corporation. In contrast, a partner can deduct losses in an amount up to the sum of the basis in the partnership interest, the allocable share of partnership income, and his allocable share of qualifying partnership debt. How the taxes work is simple. For example, each of 10 individuals contribute $100,000 to a newly formed entity to acquire an office building. The entity borrows from a bank an additional $5,000,000 as the balance of the building's $6,000,000 purchase price. If the entity is taxed as a Subchapter S Corporation, each shareholder's loss deductions are limited to $100,000. However, if the entity is an LLC taxed as a partnership, each member can deduct losses up to $600,000 ($100,000 basis plus $500,000 share of the entity's debt). These losses may then be used by the individuals to offset other income they may have from other sources.

Customer Review

Customer ReviewMy attorney for 30 years. They really do more than just set up corporations. I needed somebody to help me out of a serious legal matter they were able to take on the case for less than 1/2 of what the other attorney was charging me. Become a member of their Club it's like a hundred forty bucks a year and you get all the free legal advice you want. What a cheap insurance policy. I am so glad that I have them on my side.– Roger Davis